Unit 2, Aerial Park, Asheridge road, Chesham,HP52ZE,United Kingdom

Telephone : +44 (0) 20 8050 8069

Email : pr@printernational.co.uk

|

PR INTERNATIONAL Ltd Unit 2, Aerial Park, Asheridge road, Chesham,HP52ZE,United Kingdom Telephone : +44 (0) 20 8050 8069 Email : pr@printernational.co.uk |

Organisation in its Environment

An e-business scenario planning exercise for PR International.

Introduction

This report evaluates scenario planning processes for Pamir International in

its environment. The report examines Pamir International with regards to their

market, strategy and objectives. A background environment has been explained

at a macro and industrial level in the next section under "PR International's

Environment".

| Background |

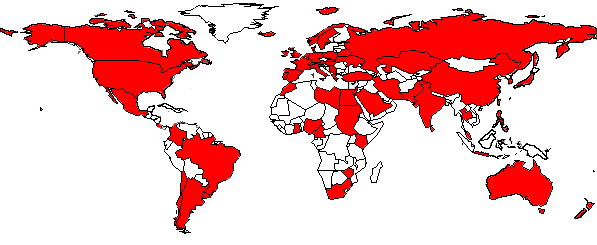

PR International is based in Watford in Hertfordshire and was first incorporated in January 1984, company registration number 1785226.. Pamir (abbreviated to PR) International is engaged in the world-wide distribution of adhesive tapes serving customers in more than 44 export markets.

| Details |

Two scenarios will be explored for Pamir International. Comprehensive analysis

on these chosen scenarios will most likely have the greatest influence on the

company. The organisational structure and culture is clearly identified with

relevance towards it's environment. Economic, ecological, demographic, political,

legal, social and technological dimensions and theories will determine future

options for this trading company.

What is investigated is:

| Conclusions |

Scenario planning is the process in which managers invent and then consider, in depth, several varied scenarios of equally plausible futures with the objectives to bring forward surprises and unexpected leaps of understanding. These scenarios represent a tool for altering the perceptions of a management team. The point is not to select one preferred future and hope for it to become true. Nor is the point to fund the most probable future and adapt to it. Rather, the point is to make strategic decisions that will be sound for all plausible futures.

Pamir International's Environment

Pamir International exports on a world wide basis. Being family owned the daily control is very much in the hands of the two shareholders. As such it is a Power Culture and the drive and direction is in the main provided by the managing director.

Pamir International exports on a world wide basis. Being family owned the daily control is very much in the hands of the two shareholders. As such it is a Power Culture and the drive and direction is in the main provided by the managing director.

The company also has an operating unit in Germany from where certain export markets are controlled.

The diagram on the left highlights in red the export markets for PR International.

| Organisational Aspects |

The Managing Director has overall control and is particularly involved with the sales activities around the world. The other director looks after financial aspects and the well-being of the two other employees, but does not spend much time in the business. The Business Manager has the task of managing the business effectively through efficient use of computer controls and increasingly looks after the benefits the Internet brings to the organisation. The Administration Controller attends to the daily office work and correspondence which arises.

There is not a Mission Statement as such, but the owner has a strong belief in Customer Care. His quote is 'Customer Care is our First Objective'. There is a strong belief that if all customers receive the highest level of care and attention all business requirements such as growth and profits will flow from there. This can be seen in the daily activity in the office. Incoming enquiries are dealt with immediately or at least acknowledged on the day of receipt. Orders for stock lines are despatched on the day orders are received to such an extent that many customers have started placing their requirements on a 'just in time' basis.

The culture of the business is clear in that it is entirely a Power Culture as described by Handy (see Charles B Handy, 'Understanding Organizations', Penguin Books, third Edition). The activities centre around the owner who is the driving force of the business. There are few rules. The philosophy is that bureaucracy is kept to a minimum, and it does not matter how the business is conducted as long as the customer received excellent service and records are kept in an orderly manner. Efficiency in conducting the business is more highly regarded than age, appearance of the staff, ethnic origin or similar aspects.

Job descriptions, demarcations and formal organisational structures are largely absent. There is encouragement given to every employee to learn every aspect of the business. Due to this teamwork is of a high order. Everyone is able and willing to take on any work that arises and people seem to be very willing to work in this environment.

| The Business |

The core business of the organisation is the supply of highly technical tapes on a world-wide basis. Technical tapes command a higher gross profit and represent a low volume/high value relationship. By contrast packaging tapes are high volume/low margin lines.

Products sold this way cover technical tapes used in the printing/graphic, building/construction, converting and other industries.

Scenario planning is a discipline for rediscovering the original entrepreneurial power of creative foresight in contexts of accelerated change, greater complexity, and genuine uncertainty. - Pierre Wack, Royal Dutch/Shell, 1984

Scenario planning is a tool for helping managers to take a view into the future in a world of great uncertainty. It is a tool to manage strategic risks and opportunities. Scenario planning is about making choices today with an understanding of how they might turn out. Peter Drucker demonstrates that management must foresee and design short and long range goals and have some sense of the external factors that affect decision making. In his 1973 study Management Tasks, Responsibilities, Practices he points out that strategy planning is not the same as forecasting as the future is unpredictable and thus strategic planning is only possible.

Process of scenario planning:

Step 1: Uncovering the decision

Strategic decisions that might have to be made in the future need to be uncovered

now.

Where is the industry going?

What is the path of development of the industry?

What events might influence it and will force us to change?

Under which circumstances might the business have an outstanding success?

Conversely what factors could be detrimental?

Step 2: Information hunting and gathering

Science and technologic developments?

Perception-shaping events, that shape or change the perception of the public?

New ideas that emerge on the "fringes" (that means not in the mainstream)

and are spreading further)

Step 3: Identifying the driving forces of a scenario

Driving forces are the elements that affect the continuity of the scenario.

In particular social forces/demographic developments, technologic developments,

economic developments and events and environmental developments.

Step 4: Uncover the predetermined elements

Predetermined elements are developments and logics that work in scenarios without

being dependant on any particular events.

Step 5: Identify critical uncertainties

Ranking key factors,and driving forces then account for degree of uncertainty.

Step 6: Composing scenarios

To explain the future, scenarios describe how the driving forces might plausibly

behave, based on assumption of predetermined elements and critical uncertainties.

Step 7: Analysis of implications of the decisions according to scenarios

How does the decision look in each scenario?

What vulnerabilities have been revealed?

Is the decision or strategy robust across all scenarios, or does it look good

in only one or two scenarios?

Step 8: Selection of leading indicators and signposts

Once scenarios and implications of decisions are determined, a few indicators

should be selected to monitor the strategy or decision in an ongoing way.

Observations from environmental factors will be built into the scenarios. Driving forces in areas such as demographic, technological, economic, political and other environmental developments will affect the scenario.

| Possible Scenarios for Evaluation. |

There are many distribution companies across the world, distributing in their own country..

Many different scenarios have been considered for evaluation, many have been rejected because:

Variables that will not change over the future:

Attending leather exhibitions globally to promote the products of PR International will continue to improve business as well as relations but would not be sufficient for a scenario based planning. It would not explore a new dimension to the business, but would merely maintain the existing business.

Financial implications and modernisation of the business are two key areas which are likely to lead to an improvement of the company. These two are investigated in detail below:

1. Financial implications with the organisation in its environment:

For financial development there are two risks factors:

a. Exchange rates and

b. Environmental Finance Stability

a. Exchange Rates

Trading in foreign currencies is largely confined to Euro, US Dollars, and to

a lesser extent Swiss Francs. If these currencies appreciate in value against

Sterling then Pamir's costs will increase. The opposite applies that when these

currencies fall in value Pamir's cost decrease. In an ideal situation the company

should sell in the same currency at which they buy, so that any exchange rate

variation is eliminated. This is not always possible. Customers in the Far East

invariably want to be invoiced in US Dollars, whereas the products sold there

have been bought In Euros. If the Euro increases in value and the US Dollar

falls then Pamir can have a significant decline in their margin. In this situation

the company has two options. One is to increase prices to customers in the Far

East, who will then claim that similar products from suppliers in the USA have

not increased in price. Secondly Pamir could engage in forward buying and selling

of currencies with banks at a certain pre arranged exchange rate. This is only

of limited benefit because if there is a long term trend of a falling dollar

this will be reflected in the banks buying rate when purchasing dollars from

Pamir on a forward basis.

There have been situations in the company's past where they have gained financially out of favourable exchange rate movements. Buying currencies have fallen and selling currencies have appreciated. Pamir however take the view that in the long term they should avoid financial speculation and aim to have as much stability as possible.

Payment terms and interest rate changes have an impact on the company but may be managed to positive affect. Pamir's working capital is partly financed out of overdraft facilities. An increase in the bank's base rate (the Bank of England has implemented recent increases and more are expected to follow) will increase Pamir's cost. It is therefore advantageous to reduce borrowing requirements. Suppliers should be put under some pressure to extend their payment terms and some inducement should be given to customers to pay early. There must also be strict control to maintain the lowest possible but workable stock level. A Just in Time, situation would be ideal and even more so if customers can pay for goods before Pamir pay for the material to their suppliers.

Turnover has increased progressively over the last few years and this has meant a higher borrowing requirement. Over reliance on loans and overdraft should be avoided because any negative and prolonged sales decline may lead banks to reduce their risk exposure and demand a reduction in borrowing.

b. Environmental changes can affect the financial performance of the company, different to exchange rate problems.

A large part of the company's sales is directed towards the synthetic leather industry. It seems safe to spread the risk of tapes over other markets instead of synthetic leather. Therefore concentrating on market changes is necessary. Synthetic leather is based on either PVC or Polyurethane components. PVC has been regarded for some years as environmentally unfriendly, particularly in Germany, Austria and Denmark, where for many uses (automotive) such products are banned. Some synthetic leather manufacturers cannot easily switch from PVC to Polyurethane production and this can result in the decline of Pamir's business. In an extreme situation environmental lobbyists may even persuade some governments to ban all artificial leather and revert to real leather regardless of the cost implications.

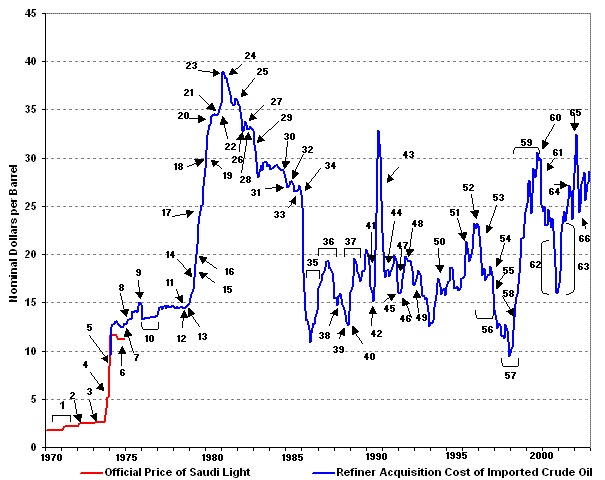

The present rise in oil prices to over $40 per barrel of North Sea Brent Crude and also US Light Oil (Business section of The Times - Aug 27th 04) will have a major effect on Pamir's customers in the synthetic leather industry. Over the past year the price has increased from $26 per barrel. This is a 54% increase in one year.

World Oil Price Chronology: 1970-2003 (chart on the left)

These customers suffer a double affect of cost increases. First, due to the fact that PVC and PU are oil derivatives and will now cost more and the manufacturing process is largely based on oil derived power. Many of Pamir's customers are in China, India, Japan, and Taiwan who are emerging and leading oil consuming nations. Their demand for oil has increased due to a variety of reasons. Manufacturing processes (synthetic leather and most others), increase in car ownership and air conditioning in a more affluent society can result in oil requirements exceeding oil production. Presently production and demand are finely balanced. Pamir is dependant on an expanding oil production and exploration because the end products of Pamir's customers fall within fashions/clothing/furniture and the automotive industry, all of which have rising demands. There is one important long term implication for Pamir. With static oil production and a rising oil demand it is quite possible that an increasing proportion of available oil will be supplied to the richer nations, leaving developing countries short, thus reducing production of goods. Increasingly so production of synthetic leather has shifted in recent years from the affluent countries to the emerging ones (China, India, Taiwan) due to lower manufacturing costs. Production companies in Portugal have extended to Brazil, where they speak the same language but can pay lower wages. Equally so Italian companies, having a Latin based language, find it easy to deal with all customers in the whole of South America (where Spanish and Portuguese is spoken). In developing countries there are less ecological restrictions so oil consumption will increase (e.g. China). Portugal and Italy fall under strict EU laws.

If oil to all countries becomes scarcer output of certain products may have to be restricted, particularly those which require high oil based energy consumption.

2. Technological development for the organisation in its environment:

There is room for the development of an e-business solution to improve the flow of information, shorten the time span of activities and to obtain more reliable data of the business. Pamir International have used computers for decades mainly to do the same things previously done manually (for example typing invoices/letters/faxes). In recent times the capability of computers have increased to accomplish more demanding tasks (advent of broadband allows online eCommerce/database management/internet phone calls).

As they are a distributor they obviously have to communicate between the manufactures of the adhesive tape and also between the customers that order the tape from them. Currently this is done by a combination of e-mail, fax, letter and by telephone which is time consuming.

An e-business solution will automate as much of the business

as possible. It involves the customer and supplier having a computer with

a "web enabled" browser. More e-mediated B2B (business-to-business)

relationships and B2C (business-to-consumer) solutions. What is required

is a business process re-engineering.

An e-business solution will automate as much of the business

as possible. It involves the customer and supplier having a computer with

a "web enabled" browser. More e-mediated B2B (business-to-business)

relationships and B2C (business-to-consumer) solutions. What is required

is a business process re-engineering.

This involves three stages of development:

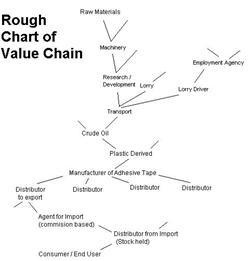

With careful planning the value chain from (operation/transaction) raw materials to consumer (goods/services) will be most efficient. Pamir typically handles a small part of the chain.

This business is about guessing how to manage resources to squeeze out the most value in ever changing environments. If the business 'knew' the value chain paths for supply chain management, there would be no 'business' - just static admin activity. This is faster more effective communication between buyers and sellers.

After a shared service centre is made, it would be a case of developing a JIT (just in time) manufacturing system, automating the sales force, with the only challenges being different currencies.

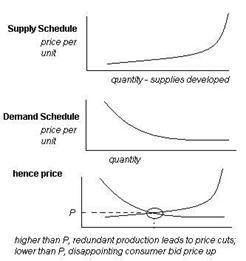

This economic system of processes can be described from this extract from Adam

Smith (The wealth of Nations, 1776,IV.ii)

The Invisible Hand:

The Invisible Hand:

"As every individual…endeavours as much as he can…to employ his capital [so] that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can…he intends only his own gain, and he is in this, as in many others cases, led by an invisible hand to promote an end which was no part of his intention"

This leads on to think why everything shouldn't be one big firm. That

is "socialism" and it doesn't work, because centralised planning

of all economy decisions is too difficult.

Why have firms at all ? There are transaction cost - research cost, contracting costs, co-ordination costs. etc. Within a small company such as PR International, transaction costs are all zero or low.

Product catalogues available on-line , with a shopping cart and billing/ordering process with choices of delivery methods designed for an export market. This is known as "online delivered content" ODC.

The design of program will link to a database whereby the intended user will have an interface to review order histories, with currently processed orders, stock management and a financial review. A SDB (Sales Day Book), PDB (Purchase Day Book) and Cash Book would do the accounting for each order.

The current system employed by PR International is completely manual. When

a new customer requires an item, their approach would be one of the following:

The customer may be referred to PR International by one of their suppliers or partners. On this basis a referral may receive a commission on an order.

The next stage is to quote the customer for their requirements. This will include:

Pricing the goods is dependent upon certain delivery variables. The customer has four choices upon the delivery method, which requires various investigations to arrive at a price.

The delivery period (lead time) brings up two choices. The requirements are

either in stock (held in house) or they have to be ordered from the manufacturer.

If the items are in stock then they will be dispatched via a shipping agent

to the company, then the customer will be invoiced. If the goods are not in

stock then the manufacturers either pass the goods on to PR International for

subsequent dispatch or they are routed direct to the customer (either through

their shipping agent or through PR International's). This method of checking

delivery and availability applies to both new and existing customers.

The need of the intended user is to save time on repetitive manual tasks. In

particular this will be shown in the following list.

The core functionality of the system is to accept orders from potential or

existing customers through the online interface. The customers will be logged

into a database which will hold their records, on which tape they require from

the online catalogue, which delivery methods they require, what payment terms

they have been given and invoicing will be automatically generated.

Autonomous systems of trade agents in E-commerce (ASTA) has been researched

and funded by the Telematics Institute (found on www.cwi.nl) for several years

now. Adaptive leaning agents (artificial intelligence) have been developed over

many years to learn profiles of consumers and spending. This can apply appropriate

routing of products from manufacturer to consumer.

Scenarios help plan for the future but don't control the future.

Environmental changes can affect the financial performance of the company

Spicing tape can be avoided in the production of PVC and PU Synthetic leather to the manufacturer, but there would be a huge inconvenience factor adding to manufacturing cost of synthetic leather, which would be far greater than any cost increase of splicing tape, due to the oil situation.

After critical analysis all of the possibilities of oil production and oil prices increasing the actual result is that production will not change and the cost increases are a global burden affecting all products using oil based energy and derivates. In conclusion, the sale of PR International's major product line will remain unaffected. Therefore it is a stable and growing business.

For a management decision, incurring more costs of research and development for alternative product structures would not be warranted.

| Technological development for the organisation in its environment |

However, disintermediation can develop whereby the middleman is pushed out, because either e-business does the job more efficiently or the service has been made irrelevant. Examples of this have happened with retail share trading / travel agencies / mortgage lending.

Therefore reintermediation must develop to continue existence of the business. Traditionally firms fight back successfully, by going digital with the benefits of extra strengths (relationship with client/customer base, knowledge, reputation, expertise in substance of field, wider product base i.e. sourcing multiple suppliers to one company).

For a management decision, this could be a fairly expensive solution for trading in future as the set-up cost and research are high. Servers, databases, scripts and programs could take months to develop. Security of internet transactions could be a risk. However the proposed system would take a significant amount of routine tasks away and eliminate potentially the need for some offices. Costs could be saved each year on renting and staff could be cut down to just two employees (Director and programmer) as arbitrary tasks could be eliminated such, as administration.

People have been discussing the "paperless office" for years and even though it is possible to develop such a solution, it is still somewhat difficult to implement it. For IT communications to be linked to both manufacturer and shipper is tricky.

Routine orders can be processed easily, however most consumers query the product more than ever and this requires human intervention. If however 50% of existing customers can be transferred to ordering online this would free up a significant saving in labour and admin, which then can be used to solve customer queries on regular orders and develop more time for improving business.

Some of the demographics of PR International's customers indicate that they would not appreciate an eCommerce interface and will maintain ordering via faxes and phone. Pamir can accept this because of their declared intention to be the best in terms of customer service.

Bibliography

Handy (see Charles B Handy, 'Understanding Organizations', Penguin Books, third

Edition

Pierre Wack, Royal Dutch/Shell, 1984

Peter Drucker , Management Tasks, Responsibilities, Practices, 1973

Business section of The Times - Aug 27th 04

Adam Smith (The wealth of Nations, 1776,IV.ii)

www.cwi.nl -autonomous solutions in ecommerce (2003 complete)